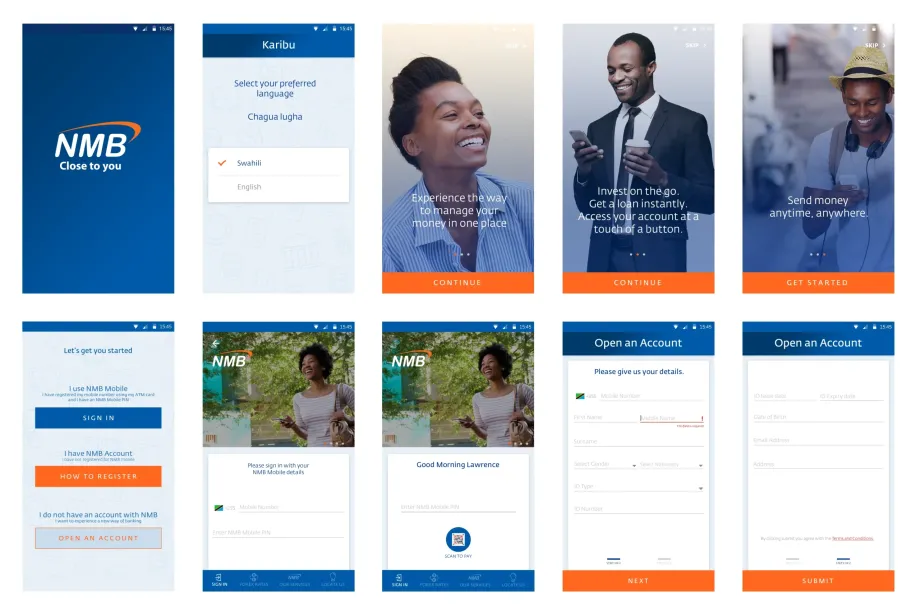

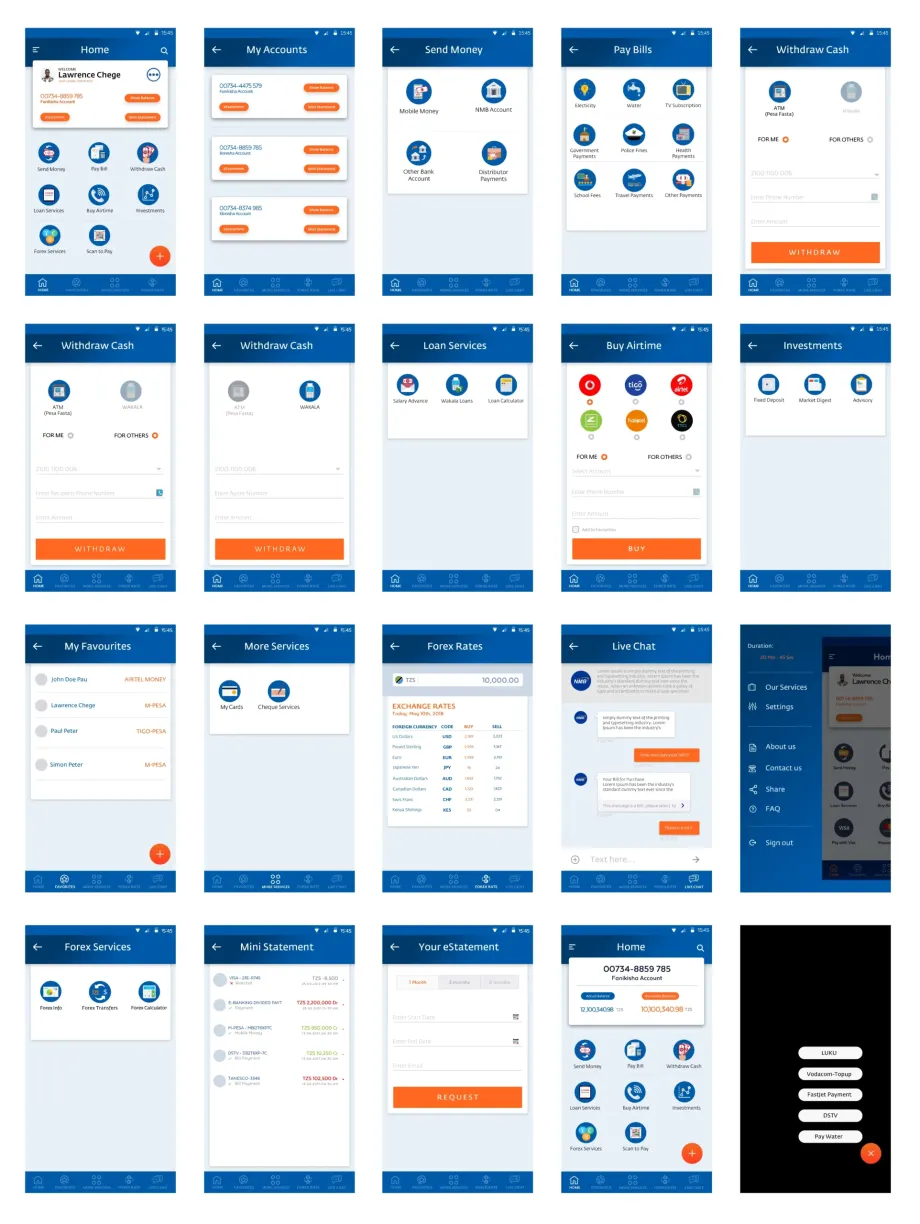

NMB Mkononi Mobile Banking

Achieved 75% adoption in 8 months with Tanzania’s highest-rated banking app.

The Challenge

Tanzania’s banking apps weren’t working for everyday people. Despite growing smartphone adoption, most apps remained difficult to navigate and poorly suited to local needs. Through competitive analysis of local banking applications, I identified critical gaps: overly complex navigation, limited language support, cluttered interfaces, and frustrating authentication processes.

NMB Bank needed a mobile solution that would genuinely serve Tanzanian customers, not just replicate Western banking patterns.

My Role

-

Role:Senior UX Designer

-

Duration:8 months

-

Tool:

Photoshop, Illustrator

I led the complete user experience design for NMB Mkononi, from research through implementation. A critical challenge emerged early: stakeholders struggled to understand the UX design process. I invested time explaining each stage—research, ideation, prototyping, testing—transforming initial skepticism into active collaboration.

The Solution

I designed a multi-language mobile banking platform prioritising simplicity and accessibility:

Intuitive Navigation: Reduced steps for common transactions through flattened information architecture.

Local Language Support: Full Swahili and English with easy switching.

Progressive Onboarding: Simplified registration guides new users without overwhelming them.

Smart Features: Saved beneficiaries and personalised shortcuts for frequent tasks.

Visible Security: Transparent security measures that build trust without friction.

Impact & Results

The application achieved exceptional adoption and transformed NMB’s digital banking presence:

-

75% adoption rate among existing customers within 8 months

-

4.6/5 star rating with 50K+ downloads.

-

80% daily active user rate – remarkable for a new product.

-

30% reduction in customer service calls.

-

25% faster transactions (from 60 to 45 seconds).

-

35% month-on-month increase in digital banking transactions.

-

20% reduction in branch foot traffic, lowering operational costs.

Customers praised the app for “finally making sense” and appreciated how quickly they could complete banking tasks. NMB Mkononi set a new standard for accessible digital banking in Tanzania.

Stakeholder Education as Strategic Investment: Time spent building stakeholder understanding of UX methodology created lasting organisational capacity for user-centred design.

Context Over Patterns: Successful solutions require a deep understanding of the local context. Western banking patterns don’t automatically translate to African markets.

Process Advocacy: Confidently advocating for proper research and testing prevented costly mistakes and delivered better outcomes.

This project reinforced that senior UX design requires building organisational understanding and ensuring user needs drive decisions, even when facing resistance.